Government to announce retail FDI rollout, allocation of coal blocks for power plants & new airport for Mumbai!Economic Times Reports!

Focus on Indian Consumers means EXPANSION of FREE Market Economy!We are NOT Citizens, but have been REDUCED as CONSUMER in the Free Market! Whoever Deprived of Purchasing Power, may not be considered as Human Being at all and SUBJECTED to Merciless ELIMINATION. Only Market Dominating Communities have the opportunity of Sustenance! The EXCLUDED Communities have NO Right to SURVIVE, Not at any Cost!India faces Rs 1.83 lakh crore exposure to US debt!

Indian Holocaust My Father`s Life and Time - SEVEN HUNDRED FOUR

Palash Biswas

http://indianholocaustmyfatherslifeandtime.blogspot.com/

India faces Rs 1.83 lakh crore exposure to US debt!

Focus on Indian Consumers means EXPANSION of FREE Market Economy!We are NOT Citizens, but have been REDUCED as CONSUMER in the Free Market! Whoever Deprived of Purchasing Power, may not be considered as Human Being at all and SUBJECTED to Merciless ELIMINATION. Only Market Dominating Communities have the opportunity of Sustenance! The EXCLUDED Communities have NO Right to SURVIVE, Not at any Cost!

Global stock markets slumped, with America's benchmark Dow Jones Industrial Average plunging over 300 points intra-day on the first day of major trade today after S&P downgraded US sovereign credit rating.

Hit hard by financial uncertainty, Dow Jones index crashed over 304 points or 2.66 per cent to 11,140.40 points in the morning trade. Similarly, S&P 500 tumbled over three per cent to 1,158.97 points while the tech-heavy Nasdaq Composite index plummeted 3.6 per cent to 2,441.45 points.

Apart from the historic downgrade of the US credit rating on Friday, aggravating debt turmoil in Europe has added to the woes of investors.

Shedding marginal gains in early morning trade, key European stock markets declined as much as four per cent in late afternoon session.

India can handle current financial crisis: Pranab Mukherjee

New Delhi: Seeking to allay fears in the wake of the economic problems in the US, finance minister Pranab Mukherjee on Monday said India's fundamentals are strong and the country is in a better position than other nations to meet the challenge although there could be some impact.

- 38%62%

Mukherjee said the country could see faster and greater FII inflows unlike after 2008 meltdown in view of the higher returns that global investors could get in India and that implementation of pending reforms could be fast tracked.

"The recent developments in the US and the Eurozone have injected certain uncertainty in global markets. These developments could have some impact on India. But as India's growth story is intact and its fundamentals strong, we are in a better position than many other nations to manage the challenge," Mukherjee told reporters outside Parliament House.

He said there could be "some impact" on capital and trade flows "but as India's growth story is strong we could see FIIs viewing India as an attractive investment destination even if there is any temporary outflow".

Mukherjee asserted that India's institutions are strong and "we are prepared to address any concern that may arise on account of the present situation".

Mukherjee's observations, sounding a note of optimism, came amidst a sharp fall in the stock markets apparently in view of the downgrading of the US economy by Standard and Poor.

Insisting that India's economic fundamentals are sound, the minister said the government would also focus on encouraging greater domestic consumption and giving greater impetus to the drivers of domestic growth.

"The government will fast track the implementation of pending reforms and keep a close eye on international developments," Mukherjee said.

He said softening of the international commodity prices, especially fuel oil, will help check inflationary pressures in the economy.

"It will also help in maintaining the fiscal balance for the year 2011-12," he said.

Source: PTI

India may face rating downgrade: S&P

New Delhi: Ratings agency Standard & Poor's today cautioned that it could lower the sovereign ratings of countries like India, Japan and Malaysia, which are still to come out of the economic meltdown of 2008.

- 82%18%

"The implications for sovereign creditworthiness in the Asia-Pacific would likely be more negative than previously experienced and a larger number of negative rating actions would follow," S&P said in its report on Asia-Pacific Sovereigns.

"Fiscal capacities of Japan, India, Malaysia, Taiwan and New Zealand have shrunk relative to pre-2008 level," it said, adding that these countries continue to bear the scars of the downturn.

The governments, it said, would be required to use their own revenue streams to support their economies and financial sector once again.

It further said that if a renewed slowdown comes, it would create a deeper and more prolonged impact.

At the time of the global financial crisis in 2008, several countries, including India, had rolled out stimulus packages facilitating monetary expansion and lower taxes to mitigate the impact of the slowdown.

At that time, India had provided three fiscal stimulus packages totalling Rs 1.86 lakh crore, which helped the economy clock a growth of 8 per cent in 2009-10, as against 6.8 per cent in 2008-09. Prior to the crisis, the Indian economy had been expanding at a growth rate of over 9 per cent over a three-year period.

Late on Friday, global ratings agency S&P downgraded its US sovereign rating to AA+ from AAA, with a negative outlook.

Source: PTI

London Stock Exchange's FTSE 100, Germany's Dax and France's benchmark Cac 40 dropped as much as four per cent, despite European Central Bank's plan to purchase government debt from debt-laden nations in the region.

Most of the Asian markets witnessed heavy sell-off even as there were some kind of buying at lower levels in markets such as India.

Chinese benchmark Shanghai SE Composite index, which plunged 3.79 per cent to close at 2,526.82 points. South Korea's key Kospi index and Singapore's FTSE Straits Times Index fell over three per cent to close at 1,869.45 points and 2,884 points, respectively.

It is Raining heavily since 3rd August in Kolkata and Weather Forcast suggests that the Raining would continue for another two days. State Govt. employees may feel relieved as they got back to back Three Days leave since Sunday thanks to CM Mamata and Tagore. RABINDRA SANGGET seems to be the Permanent Tune to wipe out Marxism, Maoism or Ambedkarite Ideology.

The India Incs Government has used the Opportunity of Double DIP Depression to Push for FDI REGIME, DISINVESTMENT and Reforms unabated. Another span of BAIL OUT is ensured. Commodity Prices and Daily Life Necessities have to be more COSTLY on which the COLONIAL Corporate EXCLUSIVE Economy Banks Most!

Prime Minister's Economic Advisory Council Chairman C Rangarajan today said the downgrade of the US sovereign rating will negatively impact exports and moderate capital flows into the country.

"More than the downgrade, what will be the impact for the rest of the world will be the slow pace of recovery in the US," he said.

"In the first half of the current calender year, the growth rate in the USA was 1.5 per cent. Perhaps for the year as a whole, other growth rates may not be much higher than that. That's a very, very slow pace of recovery and that has implications for the world in terms of capital flows, in terms of trade flow," he said.

Even Finance Minister Pranab Mukherjee said the downgrade of the US sovereign rating will have some implications on India, but added there was no need to press the panic button as the fundamentals of the economy remain strong.

"The recent developments in the US and the eurozone have injected certain uncertainty in global markets. These developments could have some impact on India. But as India's growth story is intact and its fundamentals strong, we are in a better position than many other nations to manage the challenge," Mukherjee told reporters outside Parliament House.

Mukherjee said there could be "some impact" on capital and trade flows, "but as India's growth story is strong, we could see FIIs viewing India as an attractive investment destination even if there is any temporary outflow".

Ratings agency Standard and Poor's on Friday lowered the sovereign credit rating of the US to AA+ from AAA, a development which raises concerns that investors will lose confidence in the American economy.

Justifying its rating, S&P said that predictability about US policymaking and political institutions has weakened at a time of fiscal challenge. A US Treasury official, however, said the decision of S&P was flawed.

India and China should not grow the American way and must pay adequate attention to the environment with proper policy to guide future action by both policymakers and stake-holders, green evangelist and economist Jeffrey Sachs has said.

"The main message is don't follow our (American) way," Sachs, a renowned American economist and director of the Earth Institute at Columbia University, said referring to the fossil-fuel based growth that has powered the US and other developed economies.

Sachs, who was speaking at a summit on clean energy organised by the New Indian Express and Columbia University, was critical of the way successive US governments had only paid lip-service to environmental concerns and had not framed an effective energy policy.

Talking of the exponential growth being experience by China and India, Sachs said the growing energy needs of the two economies would add more pressure to the global environment and that the governments in these countries needed to take a different approach to supplying this energy.

"China has already become the largest emitter of green house gases," said Sachs.

"We will reach tipping points in the earth's systems that will prove to be unmanageable for use and we are not planning a way out.

With the levels of carbon dioxide and other pollutants increasing at an alarming level across the globe, Sachs said current efforts at drawing more energy from renewable sources were only a small bit of what should be done and was not making much of a difference.

"We are making very little headway. With all the initiatives that are taking place they do not add up quantitatively to what we need," said Sachs.

8 AUG, 2011, 01.20AM IST, DEEPSHIKHA SIKARWAR,ET BUREAU

Government to announce retail FDI rollout, allocation of coal blocks for power plants & new airport for Mumbai

RELATED ARTICLES

- Poor governance, lack of reform driving overseas investments away

- India committed to reforms, potential to grow at 9 pc: Finance Minister Pranab Mukherjee

- FDI in multi-brand retail: Secretaries to meet on July 22

- Fuel price hikes brighten market outlook: Brokers

- India's economy skids as leaders sleep at the wheel

NEW DELHI: The government is about to announce a series of big-bang economic measures as part of a determined push to arrest a sense of despondency spreading through industry and counter perception that policymaking has all but come to a grinding halt.

The next few weeks will see up to 10 announcements comprising big-ticket policy reform measures and clearances of high-visibility projects, two officials familiar with these plans told ET. This list has been finalised by the Prime Minister's Office in concert with the finance ministry, after being shortlisted from a range of options put up by various economic ministries.

The announcements could include the launch of a quick bidding process for a new international airport in Mumbai, immediate allocation of coal blocks for power projects stuck for fuel, fast-track clearance of all pending foreign investment proposals and possibly even a phased rollout of FDI in multi-brand retail.

"Right kind of signals need to be sent out. We must complete projects that are in the pipeline. That alone can dispel any negative sentiment and revive investments," said C Rangarajan, former RBI governor and chairman of the Prime Minister's Economic Advisory Council. Planned at the highest levels of the UPA, this big-push strategy has a twopronged agenda.

Signal to the World

Primarily aimed at a domestic audience, it is also meant to send out a signal to the world that the Indian economy despite all its problems remains one of the few safe spots for investment in a shaky global economy.

"The UPA leadership is very clear that the government needs to remain focused to keep the economy on track and not allow domestic or global factors to allow the situation to get out of hand," one senior official told ET.

As the government plans to push a raft of economic legislations in the current session of parliament, the emphasis will be on measures that can be pushed through quickly using executive action and do not require building wider political consensus, which can be time consuming.

The land for the planned new airport in Mumbai has already been acquired and the project can be quickly auctioned and set into motion. The railway's freight corridor project remains in limbo for no particular reason and can be quickly scaled up.

Similarly, in case of power projects stuck because of a lack of coal availability, the government has decided to chalk out a time-bound plan to resolve all outstanding issues and make fuel linkages available to them at the earliest. On the policy reforms side, the government will focus on items that have already traveled some distance.

"A number of measures are on the anvil," another official said, adding that the exercise was also aimed at wresting the initiative and imbue some "positive energy" into the government that has been hobbled by a series of corruption scandals.

Reforms in the foreign direct investment (FDI) regime is a big element of the big push strategy. As part of this, the government is planning to give fast-track clearances to all pending FDI applications, open defence equipment sector to foreign investors through joint ventures and allow FDI into multi-brand retail projects in six big metros as soon as the policy regime is finalised.

http://economictimes.indiatimes.com/news/economy/policy/government-to-announce-retail-fdi-rollout-allocation-of-coal-blocks-for-power-plants-new-airport-for-mumbai/articleshow/9522146.cmsOur landlady`s granddaughter TUPU got married on 3rd August and Sabita has been Busy all these days.

| Local forecast dated 08-08-2011 : |

| 24 hrs forecast(Till evening of 09thAugust 2011): Intermittent rain or thunder shower would occur. One or two spells may be heavy in some areas. Maximum and Minimum temperature will be around 28°C and 25°C respectively. 48 hrs forecast(Till evening of 10thAugust 2011) Generally cloudy sky. A few spells of rain rain or thundershower would occur.Maximum and Minimum temperature will be around 30°C and 26°C respectively. |

|

|

| |||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| * 24 hours rainfall ending at 08:30 IST of date. |

http://www.imdkolkata.gov.in/

Heavy rains lashing West Bengal, more rainfall forecastIBNLive.com - 2 hours agoThe met office recorded a rainfall of 140 mm in Kolkata and 160 mm in the northern part of the city, Met officials said.Two persons were killed and eight injured in rain-related incidents in the city and adjoining Titagarh in North 24 Parganas district... More rains expected in West BengalIndian Express - 8 hours agoWith the monsoon strengthening further in West Bengal, Kolkata and its adjacent areas were expected to experience heavyrainfall. "The monsoon trough which is now placed over Digha in East Midnapore has strengthened further and the entire state, ... Time to say, goodbye nostalgiaTimes of India - 17 hours agoI don't subscribe to the renaming of Calcutta as Kolkata or of streets that had colonial names into Indian ones. Name changes don't achieve anything except a momentary fanfare. West Bengal is such an odd name - a misnomer of sorts - that people might ... The Chorus is 'Only Bengal' in the City of Joyexchange4media.com - Shree Lahiri - 11 hours agoThe Only Bengal campaign was launched by The Times of India on August 6 in Kolkata. Created by Taproot India, the campaign seeks the opinion of the people on whether the state should drop 'West' from its name and rewrite history by once gain becoming ... Heavy rains lashing West BengalBusiness Standard - 26 minutes ago"The monsoon trough which is now placed over Digha in East Midnapore has strengthened further and the entire state, including Kolkata and its adjacent areas, are expected to experience heavy to very rainfall in the next 24 hours," a met department ... |

8 AUG, 2011, 08.55PM IST, REUTERS

Recession 2011: Nasdaq falls 3.4%, S&P down more than 3% after S&P downgrade

EDITORS PICK

-

Recession 2011: European shares fall 3 per cent on S&P Downgrade

-

Global stocks slump; Asian, European markets continue to slide

-

Recession 2011: Nasdaq opens down more than 3%, Dow and S&P down more than 2%

RELATED ARTICLES

- Recession 2011: Nasdaq opens down more than 3%, Dow and S&P down more than 2%

- Wall Street tumbles on concerns over Europe, growth

- US stocks jump on stronger earnings

- Banks lead Wall St lower on US, Europe debt fears

- Wall St ends 3-day drop with help from Bernanke

NEW YORK: US stocks tumbled on Monday, the first session after rating agency Standard & Poor's cut the top-tier AAA credit rating of the United States, further unnerving already-skittish investors.

Market sectors sensitive to economic health, such as banking and commodities, were among the hardest hit, with the S&P materials index dropping 3.7 per cent and the KBW Bank index slumping 4.9 per cent.

Among individual stocks hard hit, United States Steel Corp slumped 7.6 per cent to $30.66, while Bank of America Corp dropped 9.5 per cent to $7.39.

"Everyone's hair is on fire," said Stephen Massocca, managing director at Wedbush Morgan in San Francisco.

The Dow Jones industrial average dropped 318.48 points, or 2.78 per cent, to 11,126.13. The Standard & Poor's 500 Index fell 39.40 points, or 3.29 per cent, to 1,159.98. The Nasdaq Composite Index lost 86.21 points, or 3.40 per cent, to 2,446.20.

S&P cut the US long-term credit rating by a notch to AA-plus late Friday on concerns about debt levels in the world's largest economy. The downgrade could eventually raise borrowing costs for the US government, companies, as well as consumers.

The losses on Monday came on the heels of Wall Street's worst week in more than two years on lingering concerns about flagging economic growth and fears of a financial meltdown in the euro zone.

Even the European Central Bank's dramatic intervention in bond markets, which pushed down yields on Spanish and Italian bonds, was not enough to stem selling.

But Wedbush's Massocca noted the mass selling has made some stocks attractive at lower prices.

"There are probably areas that still aren't stupid cheap yet, but I'm starting to see some stocks that are just stupid cheap. My view here is just buy them and wait," said Massocca.

Declining stocks outnumbered advancing issues on the New York Stock Exchange by 33 to two, while on the Nasdaq, decliner beat advancers about 15 to two.

In an effort to limit volatility at the market open, The NYSE invoked a special regulation known as Rule 48 to smooth trading.

http://economictimes.indiatimes.com/markets/global-markets/recession-2011-nasdaq-falls-34-sp-down-more-than-3-after-sp-downgrade/articleshow/9531843.cms

As one of the 15-largest foreign creditors to the US, India's exposure to the United States' ballooning debts is estimated at $ 41 billion -- higher than the money America owes to countries like France and Australia.

The overall national debt of the US is moving nearer to $ 15 trillion, out of which it owes over $ 4.5 trillion to foreign countries holding the US government debt securities.

While China is the single-largest holder of the US treasury securities with $ 1.15 trillion, India stands at 14th position with $ 41 billion (about Rs 1.83 lakh crore), as per the US Treasury Department.

The unprecedented debt downgrade of the US from the top-notch 'AAA' level by Standard and Poor's might also lead to an immediate action by Reserve Bank of India, which allows holding of government debt securities of countries with mostly a 'Triple-A' rating.

While a vast majority of the $ 41 billion portfolio is owned by RBI itself, some Indian banks also might have some exposure, sources said.

They said that the RBI was most likely to allow holding of the US securities even with a notch-lower rating, as it has been itself amassing the US treasury securities over the past one year despite a deepening debt crisis there.

The Indian holding has grown by about $ 10 billion in the past one year, the US Treasury data shows.

The RBI holds the US treasury securities as part of its foreign exchange reserves and the dollar holdings account for about 10 per cent of its total portfolio.

Some experts pointed out that India has been increasing its exposure on the pretext that the US debt bonds were one of the most secure from default risks.

However, the US, which was on the brink of defaulting on its debt obligations last week, was saved by way of a last-minute deal reached by President Barack Obama to raise the country's $ 14.3 trillion borrowing ceiling.

Rating agency S&P, which has based its downgrade of the country's rating on the political opposition to the government plans to fight the debt problems, has termed the rescue plan as inadequate to tackle the US debt situation.

While an exposure of $ 41 billion is a substantial figure from Indian context, this accounts for less than 0.3 per cent of the US' total debt and just about 1 per cent of its total foreign debts.

In fact, the Indian exposure is equivalent to an estimated $ 40 billion worth treasury bonds held by one single entity, Warren Buffett-led Berkshire Hathaway.

The overall foreign holding of the US government securities has grown by about $ 500 billion in past one year, while China has increased its exposure by about $ 300 billion during this period.

Among top foreign creditors, China is followed by Japan ($ 912 billion), the UK ($ 346 billion), Brazil ($ 211 billion), Taiwan ($ 153 billion), Hong Kong (122 billion), Russia ($ 115 billion), Switzerland ($ 108 billion), Canada ($ 91 billion), Luxembourg ($ 68 billion), Germany ($ 61 billion), Thailand ($ 60 billion), Singapore ($ 57 billion) and India ($ 51 billion).

Countries with lower exposure than India include Turkey, Ireland, South Korea, Belgium, Poland, Mexico, Italy, Netherlands, France, Philippines, Norway, Sweden, Colombia, Israel, Chile, Egypt, Malaysia and Australia in the respective order.

The US is still the safest place for investment, a former Obama aid said today, two days after the Standards and Poor's downgraded US credit rating from AAA to AA+ sending shock waves throughout the country. On the other hand, President Barack Obama's former top economic advisor warned Sunday of a new recession, attacking the recent US credit downgrade as an unwarranted piling on atop an already weak economy.

"Let's see how the markets react because I think there's a broad consensus that this is still the safest place to put your money," said David Axelrod, the former Senior White House adviser.

"We can debate the strength of the analysis that they did, the history of S&P and so on. They made an egregious analytical error here," he told the CBS in an interview.

"But theirs was largely a political analysis. And that's what we should focus on because what they were saying is they want to see the political system work. They want to see a sense of compromise.

They want to see the kind of solution that the president has been fighting for, a large solution that will deal with the problem, that will be balanced, that will include revenues, which will deal with some of our long-term issues," he said.

"There's no doubt that the brinksmanship that we saw was atrocious and that contributed to their analysis.

But let's review exactly what happened. For months the president was saying, let's get together, let's compromise, let's do a USD 4 trillion package that will really stabilize the debt and get us on the right path, let's do it in a way that is fair to everyone so that the wealthiest Americans are kicking in as well as the middle class and everyone else in the country," he said.

"Is review the history of what happened here. First of all, people are less concerned about that than where we go moving forward. But let's look at the history of this.

The fact of the matter is that this is essentially a tea party downgrade. The tea party brought us to the brink of a default," he said.

"The President said this if we had defaulted on our debt the consequences would have been dramatic and lasting.

And so it was the right thing to do to avoid that default. It was the wrong thing to do to push the country to that point.

It's something that that should never have happened. And that clearly is on the backs of those who were willing to see the country default, those very strident voices in the tea party," Axelrod said.

Larry Summers, former chairman of the White House Council of Economic Advisors, joined the Obama administration in criticizing Standard & Poor's first-ever downgrade of the US credit rating from AAA to AA+.

Summers insisted the country could pay its bills and repeated allegations from administration officials that S&P's decision to downgrade was linked to a $2 trillion error in its calculations and its use of a faulty baseline.

"S&P's track record has been terrible and its arithmetic has been worse," he told the CNN political talk show "State of the Union."

Summers said the major credit ratings agency acted out of "unhappiness with the solutions that are coming out of Congress for critical economic problems," but added that "the United States is going to pay its debts."

He went on to say, however, that rather than blame the S&P, US leaders should focus on speeding up the economic recovery, getting Americans back to work and avoiding a dreaded double-dip recession.

He also defended Obama's $800 billion 2009 stimulus package, saying: "There's certainly a risk of recession, but God knows if we had not pursued these policies, we would be looking at another version of what happened in the 1930s," referring to the Great Depression.

The United States has struggled to recover from its worst downturn in decades, the 2008-2009 recession triggered by the burst of a housing bubble.

S&P argued that the direction of the country's debt load and rising fiscal deficits meant it could no longer be included among the world's most risk-worthy sovereign borrowers.

Critics have cited S&P's various upbeat assessments of companies and debt instruments weeks before they failed -- including the packaged mortgage securities that sparked the 2008 financial collapse.

7 AUG, 2011, 02.53AM IST, MALINI GOYAL, SOMA BANERJEE AND MISHITA MEHRA,ET BUREAU

Despite consumption being weaker, Indian consumers still confident; important for govt to sustain investment

BSE

473.25

-00.72%

-03.45

Vol:314065 shares traded

NSE

473.05

-00.71%

-03.40

Vol:3156094 shares traded

Prices|Financials|Company Info|Reports

RELATED ARTICLES

- Indian consumer story is robust in most parts and over a longer time horizon, the story is only good

- RBI rate hike policy is a positive development for India's supply-constrained economy

- At 5.6%, May IIP slips well below estimates

- Indian slowdown, high inflation likely to persist

- Subdued, by Policy

Something curious is happening at Maruti Suzuki. 2011 has been cruel on India's largest carmaker - a crippling strike followed by plunging sales (25% down in July) has left the company and auto analysts reaching out for their seat belts. The company expects measly single-digit growth for the industry this year. At the same time, more and more people are actually walking into showrooms to actually check out new cars, says Mayank Pareek, executive director (marketing), Maruti Suzuki.

"This signals two things - sentiments are good and the intention to buy is intact but they are holding on to the purchase for interest [rates] or other reasons," says Pareek. "The consumption story is powerful and intact. Long-term bullishness remains."

Deep Kalra, CEO of Makemytrip.com, India's largest online travel portal, points out to the traveller numbers in the holiday-segment of the company's business. In the past two years, the number has more than doubled to 4,50,000. This season, Kashmir, says Kalra, had the best tourist season ever and there were no hotel rooms available for booking. India's domestic aviation traffic grew by 14 % in June - second only to Brazil (15.1%) globally. In Mumbai, the mood at the Future Group, the country's largest modern retailer, is equally upbeat. Damodar Mall, the group customer director, sees "growth coming in on the higher side".

Does this mean that Jyothi the working woman - India's aam aurat and the equivalent of the American Joe the plumber - is keeping the zipper on her purse open? Is she continuing to spend on groceries and splurge on her shopping sprees at the mall despite those 11 interest rate hikes by the central bank in the past 18 months? Will she buy that small car that she has been planning to buy for over two years, later this year? Going by what Pareek and Kalra see in their business, it looks like the great Indian consumer is not a spent force, despite many macroeconomic numbers losing their lustre.

The choices that she makes - whether to splure or tighten those purse strings - will be a large determinant of the pace at which the Indian economy will grow.

The Investment Story

So why are Jyothi's choices so important? As the folks in RBI are busy combating inflation by repeated interest rate hikes, the Indian economy's growth rate is under threat.

A few days after RBI governor D Subbarao announced the latest rate increase, the Prime Minister's Economic Advisory Council revised its growth outlook for the year down to 8.2% from 9%. Driving this weaker growth will be a 'significant weakening'in investment, said the council. And it's not just investment. "One by one, all the growth engines appear to be heading for a simultaneous slowdown," warn economists Chetan Ahya and Upasana Chachra of Morgan Stanley.

| * |

The investment story is revealing. Investment grew at 8.6% in 2010-11, up from 7.3% a year earlier. Investment growth has been sluggish for the past nine months, with the last quarter of 2010-11 showing a mere 0.4% growth. But it rebounded in the next quarter. "We have come off the peak in terms of new investment announcements. But, a lot is being implemented and being completed. Implementation did slow down in 2009-10 but the pipeline is good and therefore the investment story will continue for 2-3 years more," says Mahesh Vyas, head of the Centre for Monitoring the Indian Economy.

But Vyas's optimism on investments is not shared by other experts. Vinayak Chatterjee, chairman of Feedback Ventures and someone who works closely with infrastructure firms, says order books are weak. "My biggest concern is I don't see a good investment pipeline in the next three years," he says. "From ports to railways - pick any sector, there is just no action. Sentiments and confidence both are missing."

"Lending rates of 13.5-14% are currently at their highest in more than 12 years, suggesting that while the nascent investment up cycle can continue, it is likely to be short lived," says Sonal Varma, India economist at Nomura, an investment bank. That leaves consumption, which accounts for 58% of the GDP, as a major driver of growth. Moreover, private consumption grew at 8.6% in 2010-11, compared with 7.3% in 2009-10.

More stories from this edition of Sunday ET

- Is HCL founder Shiv Nadar's newest educational venture aim to create India's first Ivy Leaguer?

- Beware of B-1, use H-1 B: Indian IT cos now need to be extra cautious when using the business visa in place of a work permit

- Generating electricity from waves: A sustainable, 'clean' method of energy production

- Worst is over, still its early to predict the future: Tulsi Tanti, Chairman and MD, Suzlon

NRI Corner

Posted abroad? Buy property, the NRI way

Any NRI is eligible to buy a house in the country. The money should be routed by way of inward remittance from any place outside India.

- Top India focused funds for NRIs

- NRIs return to India: What's driving this rush?

- Wealth tax for NRIs

- Overseas deputation: Check tax liability

- 5 tips to avoid tax bloopers in India or abroad

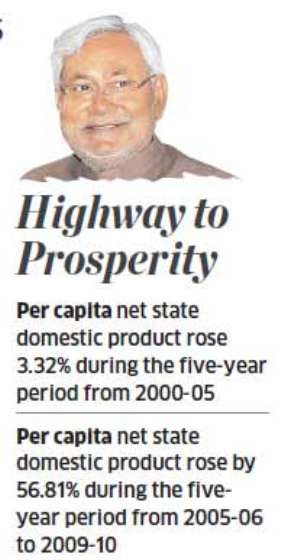

Bihar: Scripting the Growth Story

Bihar's success story: Bevy of private players vie for toll projects

2 of the projects will be toll roads, where operator has to be confident of collecting toll, a confidence that was lacking during Lalu's 15-year reign.

- Bihar's economic miracle: real, but fragile

- Bihar scripting growth story: Chetan Bhagat

- Growth at 10.49%, more than national average

- Bihar could have full literacy in two decades

- Bihar's success story impressed WB: Nitish

Smartphone Wars

RIM's launch of Bold 9900, Torch 9810 & 9850, smartphone buffs unenthused

The question is--Is there an iPhone or Android killer among them? Tech junkies are still scrutinising. Nothing's got them super excited.

- Karbonn A1 with Android, price Rs 6,990

- Steve Jobs plan for world's biggest office

- Chrome the 3rd most popular browser

- Post on Google+ & Facebook simultaneously

- MS assault on Google

How US recession is going to effect Indian economy?

India will definitely outperform other EMs

During the subprime crisis, everyone thought that the US dollar and US treasuries were safe haven, now they are not so sure.

- Current market correction good for Indian cos

- 'Global meltdown seems to be a bigger crisis'

- Expect India to outperform global equities

- Global markets overwhelmed by macro risks

- Short on emerging market stocks: Jim Rogers

Real Estate: Your Dream Home

Don't let builders spoil your home dream

Property buyers should check that all regulatory approvals pertaining to commencement and completion of the project are in place.

- When buying property, earlier the better

- Bangalore flat gets Rs 1.5 lakh rent a month

- Real estate is popular as an investment avenue

- Builders will be forced to cut prices by 20%

- Own prop

Entertainment Buzz

Priyanka Chopra to cut pop album, signs deal with Universal Music

From ruling the Indian silver screen, Priyanka will now hit the world of music with her debut album, and that too on the global stage.

- How Bollywood economy has changed

- ET Multiplex Tracker (July 29-Aug 04, 2011)

- 'I Am Kalam' gives message without preaching

- Politicians apprehensive over 'Aarakshan': Jha

- Harry Potte

Real Estate: Your Dream Home

Don't let builders spoil your home dream

Property buyers should check that all regulatory approvals pertaining to commencement and completion of the project are in place.

- When buying property, earlier the better

- Bangalore flat gets Rs 1.5 lakh rent a month

- Real estate is popular as an investment avenue

- Builders will be forced to cut prices by 20%

- Own property makes more sense

Smartphone Wars

RIM's launch of Bold 9900, Torch 9810 & 9850, smartphone buffs unenthused

The question is--Is there an iPhone or Android killer among them? Tech junkies are still scrutinising. Nothing's got them super excited.

- Karbonn A1 with Android, price Rs 6,990

- Steve Jobs plan for world's biggest office

- Chrome the 3rd most popular browser

- Post on Google+ & Facebook simultaneously

- MS assault on Google steepest challenge

http://economictimes.indiatimes.com/news/news-by-company/corporate-trends/despite-consumption-being-weaker-indian-consumers-still-confident-important-for-govt-to-sustain-investment/articleshow/9509110.cms

7 AUG, 2011, 02.59AM IST, RAMA BIJAPURKAR,

Indian consumer story is robust in most parts and over a longer time horizon, the story is only good

EDITORS PICK

RELATED ARTICLES

- Despite consumption being weaker, Indian consumers still confident; important for govt to sustain i...

- Oil-induced slowdown shows the limits to growth: John Kemp

- Dahej plastic park to get Rs 600 crore investments in first phase

- Rural India spending more on FMCG and services: NSSO

- Household bill shoots up by Rs 5.8 lakh crore on rising inflation

Where is India's consumption story going? If that's the question, and it is the question for many now, it helps to start with a recap of the uncomfortable obvious fact on Consumer India: there is no single entity called the Indian consumer whose pulse and blood pressure we can check and decide whether consumer spending is sick or well.

Consumer India is a hydra-headed monster harbouring over 230 million families who are lodged in many different Indias, each of which is subjected to many different forces that affect their earning, spending and consumption desires. Therefore to understand what is happening or going to happen to consumer spending in India, we need to understand what is happening to the people of each mini India in terms of income increases, consumption desires and confidence to spend.

God is in the detail, and though not fashionable, we need to go there because the aggregate picture is the sum total of many stories, some good some bad. And as I have often said, Consumer India is like the curate's egg: always good in parts. Sometimes when a large number of parts are not looking so good, the aggregate picture is dismal. But even alarmists, when they look at recent history, will agree that there is something to the idea of safety in numbers (of many mini Indias) because something always comes to the rescue usually and doesn't let the whole team down!

Story of Past 3 Years

Consider the past three years. At various asynchronous points in time, rural Indian consumers were in the money and the mood to consume thanks to the coming together of some acts of god and some of government; stock market investors, a small fraction but a large enough number of Consumer India, were in despair and then rode an amazing wave back to feeling rich and being rich again as the Sensex hit its highest in a long time and crossed 21,000 in November 2010 after a dismal low in 2009; the IT sector went through its wage freezes and unfreezes these past three years and the government servants had their boom time receiving lump-sum arrears in pay. In 2009-10, the Indian auto industry posted a handsome sales increase of 26%, on the back of postponed purchases.

Will incomes shrink or grow more slowly than expected in the beginning of this year? There isn't much evidence of that visible - it seems business as usual in most sectors, growing better than the growth registered the year before. According to PM's Economic Advisory Council estimates, the services sector will grow at 10% this year compared to 9.4% last year. So 25% of the labour force continues to have the same growth in income as it did last year. Most of them are self-employed in a growth sector; and if my dhobi, housekeeper and dentist are any indication, prices will only go up, given the opportunity cost of time for everyone. Even garage mechanics of cars and two-wheelers say that since the vehicle is key to personal productivity and hence income, consumers would rather spend more for quicker better service than less for worse service quality.

Many Consumers, Many Choices

Agriculture, which has over half of the labour force (though not employed exclusively in it) is expected to grow at 3% from a higher base as compared to 6.6 % last year from a far lower base the previous year - this again is pretty much normal. So, no major cause for jubilation or concern here. Big farmers and agricultural traders will see a lot more growth in incomes, and they along with rural salaried employees are the bigger contributors to rural consumption expenditure. Salaried employees in the organised sector have been given good increments for the year at 12-15% and much more at senior levels.

| * |

There is much doomsday noise about manufacturing sector slowdown - but the facts are that according to NSS 2009-10, manufacturing accounts for just 11% of the labour force , and industry as a whole 21.5% and it is projected to grow according PMEAC estimates at 7.1% (as against 7.9% last year). So again, not much to be alarmed about on the whole, though terrible in parts. The ITeS sector is expected to grow at 20% between 2009 and 2011. There are 2.3 million and 10 million people employed directly and indirectly in this sector, and new jobs will be created. Given the lack of abundant high quality talent, incomes will not only be protected but can only go up.

More stories from this edition of Sunday ET

- Is HCL founder Shiv Nadar's newest educational venture aim to create India's first Ivy Leaguer?

- Beware of B-1, use H-1 B: Indian IT cos now need to be extra cautious when using the business visa in place of a work permit

- Generating electricity from waves: A sustainable, 'clean' method of energy production

- Worst is over, still its early to predict the future: Tulsi Tanti, Chairman and MD, Suzlon

6 AUG, 2011, 06.08AM IST, WRITANKAR MUKHERJEE & SARAH JACOB,ET BUREAU

Price rise may upset festive mood this season

BSE

300.00

-03.64%

-11.35

Vol:590960 shares traded

NSE

300.60

-03.97%

-12.45

Vol:2721547 shares traded

Prices|Financials|Company Info|Reports

RELATED ARTICLES

- AC makers feel the heat as sales dip this summer

- Apparel sale slump 20% after imposition of mandatory 10% excise duty on branded garments

- Home solution retailers revive expansion plans

- Fall in cotton price unlikely to impact garment prices

- Clothing brands likely to get costlier by 35% this Diwali

KOLKATA/BANGALORE: Your buck will have less bang this festive season as makers of jewellery, consumer durables, apparel and furniture plan to increase prices by up to 15% to offset higher raw material prices. Only carmakers are expected to resist price increase this season.

Many brands said they would be cautious and increase prices in phases over the next two months because they do not want to adversely hurt consumer sentiment. Durable, furniture, apparel and jewellery companies get 30-40% of their overall revenues during the two-month festive season between Onam in Kerala in early September through to Diwali in late October. Festive sales typically start picking up nearly 30-45 days in advance.

After the recent 50 basis point interest rate increase by the Reserve Bank - the central bank has now raised the key interest rate by 3.25% since March 2010 - there are concerns that consumers may either postpone or reduce the proportion of their purchases.

ALL THAT GLITTERS

Branded jewellery makers plan 10-15% price increase mostly due to the rising gold prices. Price of 22 carat gold has moved up to Rs 2,170 a gm from Rs 2,000 in one month, while polished diamonds have become more than 18% costlier.

"We are in the process of increasing jewellery prices by 12-15%. We will evaluate a further hike in September if gold and diamond prices keep going up," said Mehul Choksi, chairman and MD of Gitanjali Group, the country's largest jewellery company and owner of brands such as Gili, Nakshatra, D'Damas, Sangini and Asmi. T Nandakumar, CFO of gold jewellery chain Joyalukkas, which operates 24 outlets primarily in South India, expects gold price to touch Rs 2,300 a gm for 22 carat gold in 2-3 months.

Yet he is optimistic about festive sales. "Since this is an auspicious period, there is forced purchase of jewellery," he said.

COSTLY APPARELS

Branded apparel too will be 12-20% costlier than last year due to higher cotton prices. Although cotton prices have softened to Rs 45,000 a candy (one candy is equal to 356 kg) from Rs 64,000 earlier, the change will not reflect in the retail price during the festive season as companies placed their orders six months ago. "The merchandise sold during festive season is crafted when cotton price was at its peak. Plus, the excise duty levy announced in budget will come into full play in the market now," ITC Wills Lifestyle CEO Atul Chand said. "In total, garment makers will have to increase apparel prices by 10-15% over the next two months," he added.

PRICEY DURABLES

Consumer durable makers too may be forced to increase prices of washing machines, refrigerators and air-conditioners from August due to 5-6% jump in prices of raw materials steel and copper as well as higher freight costs due to recent diesel price hike.

"We have little option but to pass on a portion to consumers in order to maintain margins," said Amitabh Tiwari, sales head at LG Electronics India.

OUT OF REACH INTERIORS

Style Spa too plans to increase prices 6-8% despite weak early-season demand. Its rival Godrej Interio too plans a price increase because prices of plywood, laminates, particleboard, rubber and glue have gone up.

6 AUG, 2011, 04.50AM IST, DHEERAJ TIWARI & DEEPSHIKHA SIKARWAR,ET BUREAU

Gloom on Street: Government looks to spectrum sale to boost its finances

RELATED ARTICLES

- SAIL FPO likely to hit the markets around Diwali: Report

- Indian companies avoided IPO, FPO route to raise funds in H1, 2011

- Govt to push for Concor, Ircon divestment

- Four sick PSUs on govt's 'fast track' selloff list

- NBCC IPO to fetch Rs 250 crore; shortlist 2 i-bankers by June-end

NEW DELHI: The finance ministry is to step up pressure on the defence ministry to vacate radio airwaves as it explores alternate sources to generate revenue for the government in a slowing economy.

North Block, which houses the finance ministry, is relying heavily on airwaves, or spectrum, auction given that its target to raise Rs 40,000 crore from sale of equity in state-run companies this year looks increasingly difficult to achieve because of the volatility in stock markets. "The finance ministry will look at all possible revenue raising measures," a government official said.

The disinvestment department, which is usually optimistic, is also beginning to have doubts over meeting the disinvestment target.

"If market conditions are not good, we will not push them," an official in the department said. Many of the public sector companies lined up for follow-on public offers, or FPOs, this year have also planned sale of fresh equity along with disinvestment by the government. These firms include Steel Authority of India and Indian Oil Corporation.

These companies may not want to raise equity in choppy markets where they will have to offer big discounts to woo investors.

C S Verma, chairman, Steel Authority of India told ET that the company was not keen on its FPO until market conditions improved. "It's a consultative decision, which will take place with respective administrative ministries," said the department of disinvestment official quoted earlier.

Market experts also doubt the government will be able to push through many sales. "Even if the government decides to push the button, it will only be getting 'firesale' valuation, which will not be of any benefit as per its divestment roadmap," said Jagannadham Thunuguntla, strategist & head of research at SMC Global Securities.

The government will be racing against time to push through more than half a dozen sales in the second half of the fiscal. The market may not have that much appetite. In this fiscal, the government has raised only Rs 1,162 crore by selling 5% of its stake in Power Finance Corporation. The cabinet had approved disinvestment in Steel Authority, ONGC and Hindustan Copper. Other companies on the block include Bhel and NBCC.

The possibility of a decline in tax revenues because of a slowdown in growth, and now a big time slippage in disinvestment proceeds, has increased pressure on finance ministry to find other sources of revenues.

http://economictimes.indiatimes.com/news/economy/finance/gloom-on-street-government-looks-to-spectrum-sale-to-boost-its-finances/articleshow/9500944.cms

8 AUG, 2011, 09.29AM IST, NEW YORK TIMES

S&P downgrade US credit rating: America in worst kind of decline, says Thomas Friedman

EDITORS PICK

- US downgrade: Strategies for NRI Dollar repatriation to India

- Indian diaspora tops remittance list

- All you wanted to know about NRI demat accounts

- Top India focused funds for US based NRIs to invest in

- S&P: India, Japan & Malaysia may face credit rating downgrade

RELATED ARTICLES

- 'Plenty of room' to counter slow growth: Timothy Geithner

- US will not lapse into recession: C Rangarajan, PM's Economic Advisory Council

- Recession 2011: Europe crisis revives 2008 fears but risks are less

- Double dip recession might be happening in US

- US market: Wall Street slide sends waves across US economy

In the wake of the hugely disappointing budget deal and the S&P's debt downgrade, maybe we need to hang a new sign in the immigration arrival halls at all US ports and airports. It could simply read: "Welcome. You are entering the United States of America. Past performance is not necessarily indicative of future returns."

Because our country is now finding itself in the worst kind of decline, a slow decline, just slow enough for us to keep deluding ourselves that nothing really fundamental needs to change if our future is to match our past.

Our slow decline is a product of two inter-related problems. First, we've let our five basic pillars of growth erode since the end of the Cold War, education, infrastructure, immigration of high-IQ innovators and entrepreneurs, rules to incentivize risk-taking and startups, and government-funded research to spur science and technology.

We mistakenly treated the end of the Cold War as a victory that allowed us to put our feet up, when it was actually the onset of one of the greatest challenges we've ever faced. We helped to unleash 2 billion people just like us, in China, India and Eastern Europe. For us to effectively compete and collaborate with them, to maintain the American dream, required studying harder, investing wiser, innovating faster, upgrading our infrastructure quicker and working smarter.

Instead of doing that at the scale we needed, that is, building muscle, we injected ourselves with massive amounts of credit steroids (just like our baseball players). This enabled millions of people to buy homes they could not afford and to fill jobs in construction and retail that did not require that much education. Our European friends went on a similar binge.

All this debt blew up in 2008 in the United States and Europe, and that led to the second problem: Homeowners, firms, banks and governments are all now "deleveraging" or trying to, meaning that they are saving more, shopping less, paying off debts and trying to dig out from mortgages that are under water.

No one better explains the implications of this than Kenneth Rogoff, a professor of economics at Harvard, who argued in an essay last week for Project Syndicate that we are not in a Great Recession but in a Great (Credit) Contraction: "Why is everyone still referring to the recent financial crisis as the 'Great Recession?"' asked Rogoff.

'`The phrase `Great Recession' creates the impression that the economy is following the contours of a typical recession, only more severe, something like a really bad cold. ... But the real problem is that the global economy is badly overleveraged, and there is no quick escape without a scheme to transfer wealth from creditors to debtors, either through defaults, financial repression, or inflation. ...

More stories from this edition of USA Credit Rating Downgrade

- US downgrade not to impact Indian IT cos including TCS, Wipro & Infosys in short term: Nasscom

- US downgrade not to impact Indian IT cos including TCS, Wipro & Infosys in short term: Nasscom

- US downgrade not to impact Indian IT cos including TCS, Wipro & Infosys in short term: Nasscom

- US downgrade not to impact Indian IT cos including TCS, Wipro & Infosys in short term: Nasscom

http://economictimes.indiatimes.com/news/international-business/sp-downgrade-us-credit-rating-america-in-worst-kind-of-decline-says-thomas-friedman/articleshow/9525119.cms

08/08/2011

US markets nosedive after downgrade

Investors nervous about weak US economy, European debts and Japan's recovery after quakeTraders work on the floor of the New York Stock Exchange on Monday, Aug 8. REUTERS

New York: The U.S. stock market joined a sell-off around the world Monday in the first trading since Standard & Poor's downgraded American debt and gave investors another reason to be anxious.

The Dow Jones industrial average fell more than 250 points minutes after the opening bell on Wall Street. It recovered some of those losses, then fell again and was down as many as 375 points in mid-morning trading. At noon, the Dow was down 289 points.

Monday was the first chance for global investors to respond to S&P's announcement late Friday that it was reducing its credit rating for long-term U.S. government debt by one notch, from AAA, the highest rating, to AA+.

The move wasn't a total surprise but came when investors were already feeling nervous about a weak U.S. economy, European debt problems and Japan's recovery from its March earthquake.

In this Aug. 4, 2011 photo, a trader works on the floor of the New York Stock Exchange, in New York. Global stock markets sank again Monday, Aug. 8, 2011, as worries about the downgrade of U.S. debt outweighed relief at a European Central Bank pledge to buy up Italian and Spanish bonds to help the two countries avoid devastating defaults. AP

Fresh memories of the financial crisis three years ago are also driving investors away from risky investments and into what's considered safer.

"Fear of a repeat of 2008 is what's really driving investments," said Gary Schlossberg, senior economist with Wells Capital Management.

In other trading on Wall Street, the S&P 500 index fell 38 points, or 3.2 percent, to 1,161. The Nasdaq composite index fell 83 points, or 3.3 percent, to 2,448. The Dow was at 11,156, down 2.5 percent.

The S&P 500 is already down 10 percent so far in August. If it stays down just that much, it would be the worst month for the index since February 2009.

Stock markets in Asia began the global rout. The main stock index fell almost 4 percent in South Korea and more than 2 percent in Japan. European markets opened later and fell, too, with Germany down 4.4 percent and France 4 percent.

Trader works on the floor of the New York Stock Exchange on Monday. REUTERS

Gold, which investors traditionally buy when they want a safe investment, rose more than $60 per ounce, to $1,712. Monday was the first time gold was above $1,700 although after adjusting for inflation, its price remains below its 1980 record. Gold began the year at $1,421.40. It has climbed steadily as worries rose about high debt levels in both Europe and the United States. It went above $1,500 per ounce in late May.

Prices for U.S. government debt rose -- even after S&P essentially said they were a riskier investment than the debt of some other major world economies -- because Treasurys are still seen as one of the world's few safe havens. Prices rise as demand increases.

The yield on the 10-year Treasury note fell much of the morning, to 2.35 percent from 2.57 percent late Friday. A bond's yield drops when its price rises. The 10-year note's yield fell as low as 2.06 percent in 2008.

Where Treasury prices finish the day will be more important than where they are at the start, Bill O'Donnell, head of U.S. Treasury strategy at RBS Securities, wrote in a report.

Traders work on the floor of the New York Stock Exchange on Monday. AP

"We will learn more about the future path of Treasury prices at today's close than we will by the open," he said. "I want to see how the market clears and how it synthesizes the cacophony of news of late."

Standard & Poor's also on Monday downgraded the credit ratings of mortgage lenders Fannie Mae, Freddie Mac and other agencies linked to long-term U.S. debt. Fannie and Freddie own or guarantee about half of all U.S. mortgages. Their downgrade could mean higher mortgage rates for consumers.

Worries about weaker profits that could result from a slowing economy have slammed the financial industry since late July. As a group, financial stocks in the S&P 500 index fell 4.9 percent on Monday to their lowest level since July 2009.

Bank of America Corp. has been the hardest hit. It fell 13.7 percent after AIG filed suit against the bank. The insurer alleged Bank of America sold it overvalued mortgage-backed securities. The bank denied the allegations. Its stock has dropped by nearly 50 percent this year.

A trader works on the floor of the New York Stock Exchange. REUTERS

Stocks in other industries whose profits are closely tied to the strength of the economy also fell sharply. Energy stocks in the S&P 500 fell 4 percent, for example.

The smallest losses came in safer industries whose profits tend to be steadier, regardless of the economy. Even in a bad economy people will still buy things like toothpaste and bread. Consumer staple stocks fell just 1.5 percent. Utilities, also a necessity for consumers, fell 2.8 percent.

The Vix index, a measure of fear among investors, shot up 19 percent to its highest level since May 2010. The index shows how worried investors are that the S&P 500 will drop over the next 30 days. It does this by measuring prices for stock options that investors can buy to help protect their portfolios.

Investors are worried that Spain or Italy could become the next European country to be unable to pay its debt. The European Central Bank said it will buy Italian and Spanish bonds in hopes of helping the countries avert a possible default.

Seeking to avert panic spreading across financial markets, the finance ministers and central bankers of the Group of 20 industrial and developing nations issued a joint statement Monday saying they were committed to taking all necessary measures to support financial stability and growth.

"We will remain in close contact throughout the coming weeks and cooperate as appropriate, ready to take action to ensure financial stability and liquidity in financial markets," they said.

Crude oil, natural gas and other commodities fell on worries that a weaker global economy will mean less demand. Oil fell $3.47 to $83.41 per barrel.

A trader works on the floor of the New York Stock Exchange. AP

Last week, the Dow Jones industrial average fell almost 700 points. That was its biggest point loss since October 2008, during the financial crisis. The Dow has dropped in nine of the last 11 trading days.

Worries about the U.S. economic recovery have been building since the government said that economic growth was far weaker in the first half of 2011 than economists expected.

The economy grew at a 1.3 percent annual rate from April through June, below economists' expectations. It expanded at just a 0.4 percent rate in the first quarter. The first half of 2011 was the slowest since the end of the recession.

Then reports showed that the manufacturing and services industries barely grew in July. Job growth was better than economists expected last month. But the 117,000 jobs created in July were still well below the 215,000 that employers added between February and April, on average.

The Federal Reserve will meet on Tuesday, but economists don't expect much to come out of the meeting. The central bank's key interest rate is already at a record of nearly zero, where it has been since 2008. The Fed has also already said that it plans to keep rates low for "an extended period."

Traders work on the floor of the New York Stock Exchange on Monday. AP

The central bank finished a $600 billion program in June to buy Treasurys in hopes of supporting the economy. Chairman Ben Bernanke said last month that the Fed would step in to help the economy if it further weakened. But some Fed policymakers oppose more bond purchases, saying it could lead to higher inflation.

Fears about a weaker U.S. economy have overshadowed profit growth that companies have reported for the second quarter. For the 441 companies in the S&P 500 that have already reported, earnings rose 12 percent in the second quarter from a year earlier. Revenue growth has also topped 10 percent for the first time in a year.

Tyson Foods rose 0.8 percent after it reported stronger profit than analysts expected. The largest U.S. meat company said its net income fell 21 percent because of higher grain costs, but analysts expected a steeper drop.

Tyson was one of just five stocks in the S&P 500 to rise on Monday. The biggest gain came from Newmont Mining Corp., which benefited from higher prices for the gold that it produces.

Source: AP

08/08/2011

US crisis may benefit India, says FICCI

New Delhi: India will be impacted in the short term because of the US sovereign debt crisis, but it will also benefit from the economic turmoil as softening crude prices will bring down inflation, prompting the Reserve Bank of India (RBI) not to hike rates, a leading industry lobby said Monday."One positive fallout of the rating downgrade, we feel, could be the Indian market perception that a possible decline in crude prices may signal a pause in RBI rate hikes, buoying investor sentiments," the Federation of Indian Chambers of Commerce and Industry (FICCI) said in a statement.

"Additionally, the spreads between a US sovereign and Indian sovereign paper of comparable duration may decline, thus acting as an enabler to foreign institutional investors inflows into the country. This may have a sobering impact on the current account deficit, even though this may not be exactly desirable."

Global stock markets continued to fall Monday after top credit rating agency Standard and Poor's downgraded the US sovereign debt rating last Friday and cautioned of a further downgrade if the fiscal position of the country did not improve.

As far as the impact of the crisis on the Indian economy, FICCI said some short-term impact would be seen in terms of market uncertainties.

"An uncertain global environment could, however, depress India's exposure to global markets (exports of goods and services, more than a quarter of India's GDP) and knock off percentage points from India's GDP growth," the industry lobby said while outlining some of the risks.

Source: IANS

5 AUG, 2011, 06.47AM IST, DEEPSHIKHA SIKARWAR,ET BUREAU

Developers, investors queuing up to make the most of the growth story in Bihar

EDITORS PICK

- Private cos like GMR aggressively aquiring new road projects

- Government nod to 4-laning of Jabalpur-Katni--Rewa project for Rs 1,981 crore

- New land bill may hold up infrastructure projects in North India

- GVK emerges as frontrunner to develop and operate Shivpuri-Dewas national highway in MP

NEW DELHI: Eight years ago, the headline story from Bihar was the gruesome murder of IIT-Kanpur engineer Satyendra Dubey, who blew the whistle on corruption in road projects.

Today, the same state is attracting private funds in the same sector, a complete turnaround after six years of Chief Minister Nitish Kumar's rule.

These investments are even more remarkable because two of these projects will be toll roads, where the operator has to be confident of his ability to collect toll, a confidence that was lacking during Lalu Yadav-led RJD's 15-year reign.

That's not all. Officials of the Bihar State Road Development Corporation now keep tabs on how projects are progressing using smartphones running Google's Android OS, from their offices in district headquarters. Bihar is the first state in India to put mobile technology to this use.

Of the two private road projects, the first is a Rs 1,602-crore project to build a 5.5-km bridge across the river Ganga, connecting Bakhtiyarpur with Shahpur along with a four-lane 45.5 km approach road. The second is a Rs 917-crore project to widen the twolane road between Ara and Mohania into a four-lane one.

"These two projects will substantially improve connectivity in the state," Bihar Deputy Chief Minister Sushil Kumar Modi told ET.

"Bihar isn't what it used to be," said Ullhas N Bhole, vicepresident, Atlanta Infrastructure, which has bagged the Ara-Mohania project.

Bihar has constructed 23,606 km of roads since 2006-07, apart from augmenting and repairing 1,657 km of national highways. All these projects involved annuity payments because private builders were not ready to build toll roads, fearing they wouldn't be able to collect fees from users. "The law and order situation is good and we do not see any problems in collecting toll," said Bhole.

"The Public-Private Partnership Approval Committee under the finance ministry has given its nod to the Ganga project," a finance ministry official said. The project had to be approved by the finance ministry as it needed some viability gap funds from the Centre.

http://economictimes.indiatimes.com/news/economy/infrastructure/developers-investors-queuing-up-to-make-the-most-of-the-growth-story-in-bihar/articleshow/9487070.cms5 AUG, 2011, 02.52PM IST, ECONOMICTIMES.COM AND AGENCIES

Effect on currencies and commodities markets around the world

EDITORS PICK

- Indian IT companies confident of withstanding US-led downturn

- 'US crisis may hit exports, GDP intact at 8.2%'

- TCS, Singapore Univ to collaborate in IT solution

- Nifty could head towards level of 4,800 or lower

- TCS says demand not affected by market rout

RELATED ARTICLES

- Losses seen on S&P action, but panic unlikely

- Recession fears: Bond yields, swaps plunge on global safe-haven flight

- Central banks of Emerging nations buy $10 bn in gold as West wobbles

- World markets slump on growth fears, gold hits record

- Asian stocks fall on weak data; eyes on yen

NEW DELHI: Global stock markets tumbled on Friday amid fears the U.S. may be heading back into recession and Europe's debt crisis is worsening. The sell-off follows the biggest one-day points decline on Wall Street since the 2008 financial crisis.

Here's a consolidated snapshot of what's going on in Currencies, commodities and Bonds around the world.

Currencies:

The rupee was near its weakest level in over five weeks in afternoon trades as domestic equities stayed deep in the red, tailing the global shares rout, fuelling concerns of outflows.

The partially convertible rupee was at 44.79/80 per dollar, after touching 44.8550, its lowest since June 29. The rupee had settled 0.5 percent weaker on Thursday at 44.545/555.

The Swiss franc pulled back from a record high against the euro as nervous traders cut long positions in thin trade, but mounting fears of an economic quagmire in the United States and Europe were likely to keep safe-haven currencies in demand.

The yen edged higher and bounced away from a three-week low hit the previous day after Japan's massive yen-selling intervention, but concerns that the Japanese could intervene again limited the currency's rebound.

The dollar was under pressure against the yen Friday on widening fears of a global slowdown, despite speculation Japan may step into markets again and buy the greenback to temper the soaring yen.

The dollar traded at 78.54 yen, down from 78.93 yen in New York, a day after Japan intervened in forex markets to stem the yen's rise.

Commodities:

Gold edged up more than half a percent as investors used bullion to shelter from the storm engulfing financial markets on concerns that the United States may be facing another recession and Europe's debt crisis is spreading to some of its largest economies.

Spot gold rose 0.84 percent to $1,661.66 an ounce by 0617 GMT, having hit a low of around $1,641. Bullion struck a record around $1,681 an ounce on Thursday before losing much of the gains.

Morgan Stanley raised its price forecast for gold to $1,511 from $1,401 for 2011, citing enhanced contagion risk from the European debt crisis and continued uncertainty over U.S. macroeconomic outlook.It also lifted its 2012 price outlook to $1,624 from $1,330.

India gold futures extended gains for a fourth session to hit a new peak following a rally in overseas markets and a weaker rupee, which traded at its lowest level in five weeks, pushing physical traders to the sidelines ahead of a slew of festivals starting later next week.

The most-active gold for October delivery on the Multi Commodity Exchange (MCX) struck a record of 24,300 rupees per 10 grams, before trading 0.75 percent higher at 24,247 rupees.

Oil prices extended sharp losses, falling to near $85 a barrel Friday in Asia amid expectations of a slowing global economy will weaken demand for crude.

Benchmark oil for September delivery was down $1.31 to $85.32 a barrel at late afternoon Singapore time in electronic trading on the New York Mercantile Exchange. Crude tumbled $5.30 to settle at $86.63 on Thursday.

Global commodity benchmark the Reuters-Jefferies CRB index is down more than 4 percent for the week, its biggest drop since losing nearly 9 percent in May's across-the-board slide, also fueled by global growth concerns.

London copper dropped 2 percent to $9,165 a tonne, after hitting a low of $9,143 a tonne, a level not seen since June 29. Zinc was down more than 3 percent and lead, nickel and tin slid over 2 percent.

In Shanghai, aluminium and zinc slumped by their daily trading limits of 4 percent and 6 percent, respectively, while copper dropped 4.3 percent.

Shanghai rubber futures fell as much as 5.8 percent to 33,605 yuan per tonne and in Malaysia, palm oil futures dropped 2.6 percent to a session low of 3,021 ringgit.

In the grains market, Chicago Board of Trade wheat fell more than 2 percent to as low as $6.67 per bushel and corn dropped 1.6 percent to $6.90-1/2.

Bonds

Indian bond yields and swaps plunged as investors scurried to safe-haven government securities across regions on renewed concerns over global economic recovery.

Local bond dealers preferred to hold on to fixed-income securities as hazy global outlook outweighed domestic worries such as the central bank's persistent anti-inflationary stance to tame stubbornly high inflation.

The 10-year benchmark bond yield was 9 basis points lower at 8.31 percent, its lowest since July 26. Traders expect it to trade in a 8.28-8.35 percent band in the day.

Positions in equities and commodities were being scrapped and a scramble for the safety of cash and top-rated government bonds was on. In the global bond markets, short-term core European government debt was in demand.

Apart from signs that the U.S. and global economy is weakening -- despite record low interest rates and the pumping of liquidity into the system -- the focus was clearly on Europe, where bond yields in Spain and Italy have been blowing out, threatening the same kind of refinancing problems that have already smitten Greece, Ireland and Portugal.

Italian 10-year government bond yields rose above their Spanish equivalent. Italy has emerged as the market's major concern after a rescue deal that was intended to stop the spread of the crisis failed to convince investors it had the firepower to ease pressure on the vast Italian bond market.

http://economictimes.indiatimes.com/markets/commodities/effect-on-currencies-and-commodities-markets-around-the-world/articleshow/9493064.cms

7 AUG, 2011, 07.00AM IST, TNN

Will gold investment be the last refuge?

RELATED ARTICLES

- US debt deal brings relief, now downgrade awaited

- US bonds are safest investment at this point: Maarten Jan Bakkum, ING Investment Management

- Defensive stocks are safe bets in volatile market condition

- Stock up on equities now for long-term gains

- Next Quarter will be a good time for the long term investors to get into the market: Sampath Reddy,...

With the credit rating of the US downgraded, equities would trip only to rise later and the lure of gold, which is seen as one of the few safe haven assets left to cover risks, would grow. The stock markets are likely to open lower and remain subdued for the rest of the week.

However, the news could well turn turn out to be a positive one for the Indian equity market in the long term. Investment experts believe this could happen if crude prices continue the downward journey along with inflation numbers and the Reserve Bank of India holds back its rate hikes on the back of global turmoil.

"Given the nervousness, investors would flock to gold," said Dhruva Raj Chatterji,senior research analyst with Morningstar India, an investment research firm. The yellow metal would emerge as the clear winner in the current spell of uncertainty but some believe that there would be more inflows into emerging markets (EMs).But there is a catch.If the Rupee strengthens then the prices of gold will fall in the domestic market. Some experts also believe that gold has already appreciated 34% this year and investors should be careful about a bubble building here.Also,some investors are likely to sell gold in the near term to reduce losses in equity.

In equities, some are already predicting 10-20 % correction from the current levels. "Equities would react negatively (to the downgrade) but there is not much downside left to this market," said Rupesh Nagda, head (investment advisory and products) with Alchemy Capital Management. "Company-specific risks would be there. But there would not be any valuation-related risks," Nagda said.

Most companies on the Sensex are trading at 14 times their 2012 earnings , down from 21.5 times in March 2010. That is why many investment experts believe that the valuations are attractive to enter the market at current levels. However, investors should be careful about export-dependent sectors like IT, as they are likely to feel the heat of the cuts in spending by the US government.

However, this is not to suggest that investors are likely to act with a lot of sagacity next week. Most investors are likely to play safe and try to protect their capital. "There would be a kneejerk reaction initially. People would move to safe haven assets," said Anil Rego, CEO of Right Horizons, a wealth management firm. Investors should stay with short-term debt funds as the RBI may not go for aggressive rate hikes if the global economic situation worsens,observers said."The last three rate hikes did not have any significant impact on bond yields," Rego said.

Palash Biswas

Pl Read:

http://nandigramunited-banga.blogspot.com/

1 comment:

This is wonderful. I am not quite much with the internet, but I believe that what I just read is some good material. Thanks for writing such wonderful article. God bless.

buy herbal incense online

Post a Comment